Balancing Hat Tricks

How to avoid trouble when wearing multiple hats

At Briefcase we deal with business owners who want the best for their business but often are confused about what they need to do to ensure the maximum protection for their business and for their personal assets. You may have heard us say recently that over 80% of legal documents downloaded online are filled out incorrectly by the end user. This has the potential for disastrous consequences to a small business, not to mention the burden our legal system bears to resolve disputes related to transactions which are ineffectively executed.

Don’t subject yourself to unnecessary risk

One issue that frequently arises with closely held companies when entering any transaction is recognizing the distinction between the owner(s) of the entity and its manager(s) or officer(s). Lines can easily become blurred where the same person is required to take on multiple roles. A business that does not adequately separate respective roles or co-mingles personal finances with those of their business subject themselves to unnecessary risk. A business that fails to follow its organizational formalities does so at its own peril – creditors of the corporation may attempt to nullify the benefits of limited-liability status via a concept known as “piercing the corporate veil,” whereby an entity is deemed to be the mere “alter ego” of its owners because the owners didn’t maintain a distinction between their own affairs and those of their company.

This is why you will see that many Briefcase documents might require one individual to sign a document more than once on the same signature page. Although an “agreement with yourself” might seem ridiculous, it serves an important purpose. Whether a person’s signature is meant to bind their company or just that person individually is an important distinction. This is where wearing different hats comes into play.

Avoid the troubles that come from blurring the lines

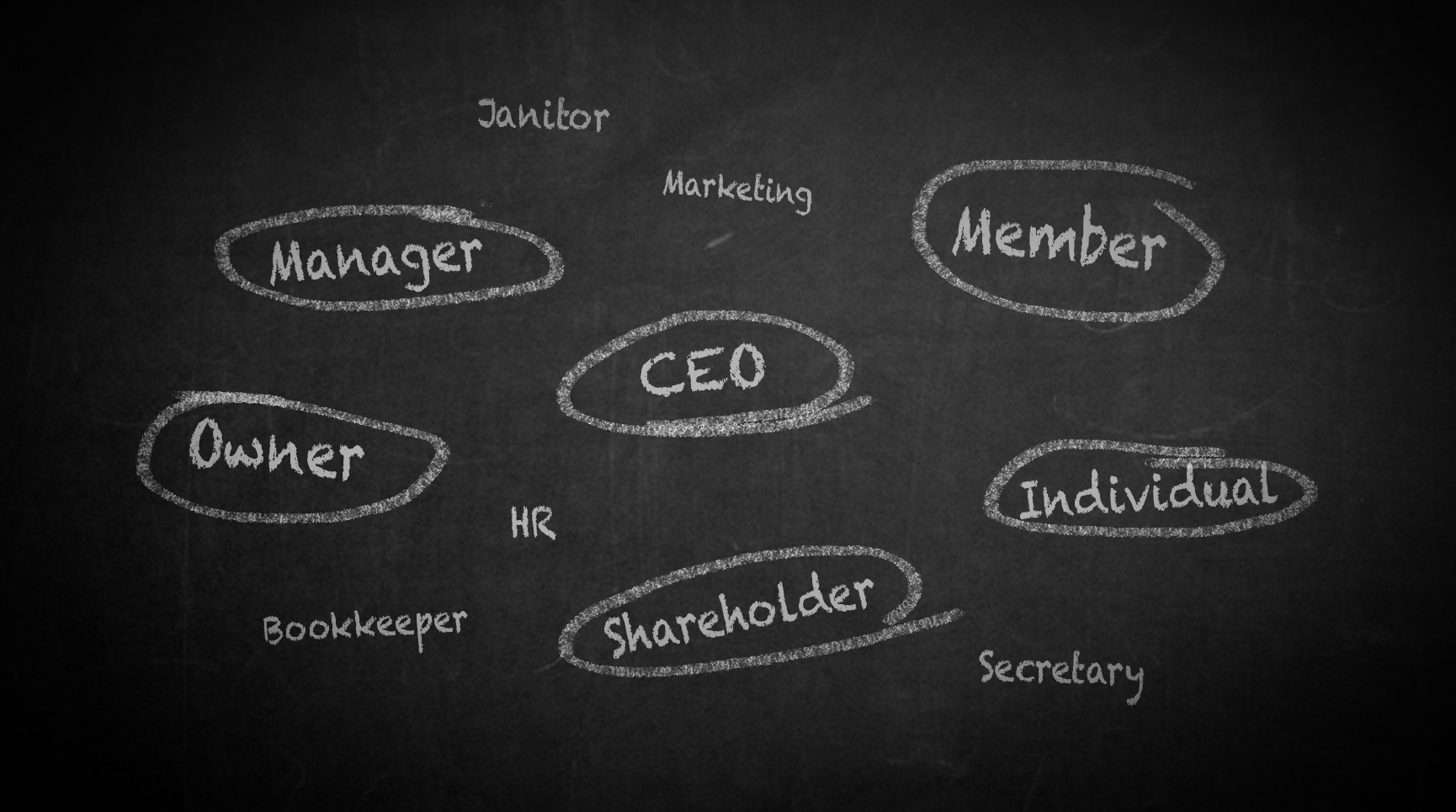

Every business owner knows that in a small business their job description is varied. Head of human resources, bookkeeper, secretary, marketing director, janitor . . . business owners are spread thin when managing their businesses. However, when it comes to obligating the company to a transaction, it is vital that the business owner specify the right corporate capacity and authority under which they operate.

It is also important to be mindful of the key areas where business owners often run into trouble. When executing any legally binding document ask yourself these questions to make sure you have the right hat on:

Formalities – Am I following the corporate formalities that were established by my business when it was formed?

Co-Mingling – Does this transaction co-mingle or combine any of my personal assets or funds with the assets and funds of my business?

Misrepresentation – Are the signature blocks correct regarding the right corporate capacity? Are we making any representations of the authority we have to enter into this agreement? Are those representations correct?

Negligence – Is this agreement or transaction establishing any legal duties that the business must be cognizant of? What situations would breach that duty and possible cause harm?

The lesson we teach to all our Briefcase clients is that you should always be mindful of which legal “hat” you are wearing. Is it the “owner/shareholder/member” hat? The “officer/manager” hat? The “individual” hat?

Questions: What hats and roles do you and each of your owners fill for your company? What structure can you implement to avoid wearing the wrong hat at the wrong time?